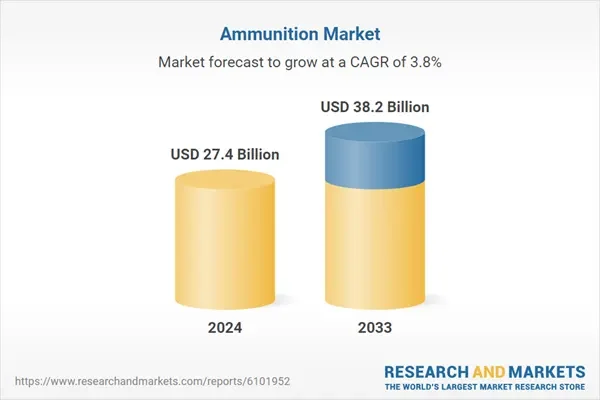

The global ammunition market is experiencing steady, sustained growth that extends well beyond the $30 billion threshold by 2030. According to the 2025 ‘Ammunition Market Size, Competitors & Forecast to 2030’ report from Research and Markets, the global ammunition market is projected to grow from about $28.1 billion in 2024 to roughly $35.9 billion by 2030, a 4.2 percent compound annual growth rate. With this compound growth, it is projected to reach over $50 billion within the next 8-10 years, driven by converging forces: escalating defense budgets worldwide, evolving geopolitical tensions, technological modernization across military arsenals, and rising demand for precision-guided and intelligent munition systems. Understanding these market dynamics not only clarifies industry trends but also reflects how shifts in global security priorities reshape demand for ammunition across military, training, and specialized applications.

Key takeaways

- The global ammunition market was valued at approximately $28–36 billion in 2024 and is projected to reach $35–52 billion by 2030–2034, growing at compound annual rates between 3.1% and 4.2%.

- Rising global defense expenditures, geopolitical instability, military modernization, and demand for precision-guided munitions are the primary drivers accelerating market expansion.

- North America leads the market currently, while Asia-Pacific is experiencing the fastest regional growth, with increasing investment in advanced artillery, guided systems, and long-range capabilities.

The Current Market Size and Forecast Trajectory

The global ammunition market stood at approximately $28 to $36 billion in 2024, depending on the research firm’s methodology and scope. Most comprehensive forecasts project the market to reach between $35 billion and $52 billion by 2030–2034, with compound annual growth rates (CAGR) ranging from 3.1% to 4.2%. While this may appear modest compared to more volatile sectors, it represents steady, predictable expansion in a capital-intensive, heavily regulated industry where consistency matters more than volatility.

The variance in projections reflects different scopes and geographic coverage. Some reports focus strictly on traditional ammunition categories (bullets, shells, grenades), while others integrate emerging guided systems and advanced variants. Regardless of the specific figure, the consensus is unambiguous: ammunition demand is climbing at a faster rate than general economic growth, signaling that structural factors, not temporary spikes, are driving the expansion.

| Dimension | 2024–2030 trend and figures | Why it pushes toward $35B+ by 2030 |

|---|---|---|

| Total global market size | Forecast in the low‑to‑mid $30B range by 2030, with CAGRs around 3-4% percent. | Compounding growth from a high‑20s‑billion base naturally reaches $35B+ band. |

| Defense vs. commercial share | Defense and homeland security remain the largest buyers, with commercial (sport, hunting, self‑defense) a substantial minority share. | Combined institutional and civilian demand keeps factories at high utilization. |

| Small‑caliber segment | Small‑caliber market grows from about $8.1B in 2023 to about $9.8B by 2030 (≈2.7% CAGR). | Everyday training, hunting, and law‑enforcement use create durable base demand. |

| Artillery and medium calibers | Artillery ammo projected around $7.3B by 2030 at ~5.4% CAGR, with strong medium‑caliber growth. | High‑value military rounds add revenue even if unit volumes are modest. |

| Technology and “smart” ammo | Programmable and advanced munitions grow from under $4B mid‑2020s to well over $5B by 2030. | Value per round rises as buyers shift to guided, specialty, and eco‑friendly loads. |

| Regional demand | North America holds roughly 40–50% share in many studies; Asia‑Pacific and Europe are fast‑growing followers. | Multiple regions increasing budgets and civilian use spreads growth globally. |

What’s Propelling Ammunition Market Growth?

Rising Global Defense Expenditures

The most significant driver of ammunition market expansion is the upward trajectory of defense spending worldwide (Global defense spending hit a record $2.7 trillion in 2024). Governments across North America, Europe, and Asia are allocating substantially larger budgets to military modernization, personnel, equipment, operations, and critical infrastructure. These increases reflect heightened concerns over national security, regional conflicts, technological competition with peer adversaries, and the need to maintain credible deterrence capabilities.

Defense budgets are not spent uniformly. A growing share flows toward upgrading aging arsenals, acquiring advanced technologies like artificial intelligence and autonomous systems, and enhancing cyber defense capabilities. Ammunition procurement is a direct consequence of this shift. As armed forces upgrade their platforms and doctrine, they simultaneously expand orders for compatible munitions, both for operational readiness and for training crews on new systems. This multiplier effect accelerates ammunition demand beyond simple population or military personnel growth.

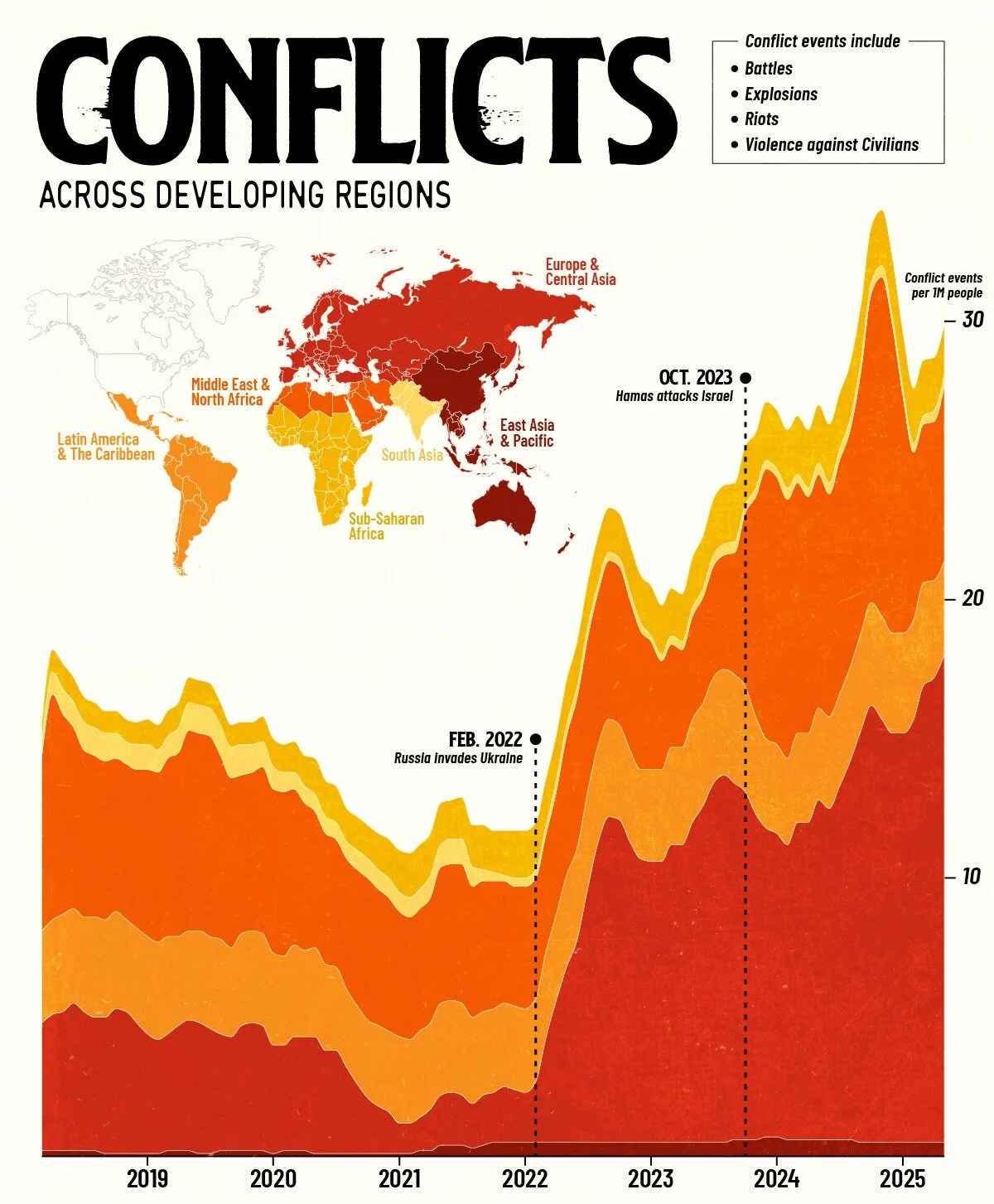

Geopolitical Instability and Regional Conflicts

Ongoing and emerging regional conflicts create sustained demand for ammunition across multiple caliber ranges and munition types. Whether in Eastern Europe, the Middle East, or contested maritime zones, protracted or recurring conflicts consume ammunition at rates that drive procurement cycles. Beyond active conflict zones, military planners worldwide are reassessing readiness postures and increasing stockpile levels in response to perceived threats, creating an additional demand signal beyond routine operations.

This dynamic is not temporary. Historically, periods of geopolitical tension sustain elevated ammunition procurement even when active combat is not occurring, because military organizations maintain strategic reserves, and training intensity remains high.

Modernization of Artillery and Long-Range Systems

A critical trend within the ammunition market is the shift toward precision-guided, intelligent, and long-range munition systems. Modern militaries are investing heavily in advanced artillery rounds that offer greater accuracy, extended range, modular designs, and enhanced battlefield survivability. These systems represent a premium segment within the broader ammunition market and command higher per-unit prices, amplifying market value growth even when unit volumes may grow more slowly.

The development of specialized munition variants, including training rounds, incendiary shells, and environmentally compliant options, also fragments the market into higher-margin segments. A single modern artillery platform may require ammunition across multiple specialized categories, further expanding total procurement value.

Demand for Advanced Training Variants

Military organizations are increasing investment in training infrastructure and crew proficiency. Advanced training rounds allow forces to conduct realistic exercises without the cost and logistical burden of full combat munitions. This category is expanding as militaries prioritize readiness and soldier safety, creating a separate demand stream that did not exist at scale a decade ago.

- Advanced training ammunition is engineered to closely mimic the ballistics, recoil, and handling of live combat rounds, so units can rehearse tactics and weapon manipulation under realistic conditions while minimizing risk.

- Because training variants reduce barrel wear, collateral damage risk, and range maintenance costs, they let militaries increase the number of live‑fire iterations per soldier without proportionally increasing operational expenses.

- As more forces shift to “train as you fight” standards and higher annual qualification requirements, procurement officers are carving out separate budget lines for dedicated training ammunition, turning what was once a small niche into a meaningful, recurring demand stream.

Regional Leadership and Growth Hotspots

North America’s Current Dominance

North America, particularly the United States, commands the largest share of the global ammunition market. This dominance reflects the region’s substantial defense budget, large military establishment, robust domestic ammunition manufacturing base, and ongoing modernization programs across all service branches. The U.S. market alone accounts for a significant portion of global ammunition value, and North American export activity influences supply and demand patterns across allied nations.

Asia-Pacific’s Rapid Expansion

While North America leads by absolute market share, Asia-Pacific is identified as the fastest-growing region during the forecast period. Countries across the region are significantly increasing defense expenditures in response to regional security challenges, technological competition, and the need to modernize aging platforms. China’s ammunition market is forecasted to grow at particularly robust rates, reflecting both domestic modernization and export ambitions. Japan, South Korea, India, and other regional powers are similarly accelerating ammunition procurement and domestic production capacity.

This regional shift is significant for the global market because it signals that ammunition demand is not concentrated in a single region but is becoming more geographically distributed, supporting sustained global market expansion.

European and Emerging Market Considerations

Europe’s ammunition market remains substantial, particularly as NATO members increase defense spending and procurement in response to regional security concerns. Emerging markets and developing economies, while smaller in absolute value, are beginning to represent faster-growing segments as these countries modernize their military capabilities and increase defense budgets.

The Rise of Precision, Guided, and Smart Munitions

One of the most transformative trends within the ammunition market is the adoption of precision-guided and intelligent munition systems. These represent a fundamental shift in how modern militaries conceptualize firepower. Rather than relying purely on volume and area suppression, advanced systems emphasize accuracy, reduced collateral damage, and enhanced mission effectiveness.

Precision-guided rounds and modular ammunition systems command premium pricing compared to traditional munitions, which accelerates market value growth even as unit volume expansion may be more modest. Additionally, the integration of artificial intelligence and Internet of Things (IoT) technology into ammunition systems is creating entirely new product categories and use cases. “Smart” munitions capable of real-time targeting adjustments or enhanced battlefield awareness represent next-generation demand that did not exist a decade ago.

The environmental and compliance dimension is also driving this shift. Modern militaries are increasingly required to meet environmental standards and minimize collateral damage through precision munitions, creating regulatory pressure that favors advanced over legacy ammunition types. This regulatory environment supports market expansion toward higher-value products.

Market Segmentation and Specialty Ammunition

The ammunition market is not monolithic. Segmentation by caliber, application, guidance system, and munition type reveals distinct growth patterns and opportunities. Small-caliber ammunition (rifles and handguns) represents a substantial baseline market but grows more slowly than specialized segments like precision artillery rounds, guided missiles, and advanced training variants.

Large-caliber artillery ammunition, including howitzer and cannon rounds, is a critical high-value segment. Historically, these munitions have driven significant market activity due to their cost and deployment in sustained land warfare scenarios. With modern military doctrine increasingly emphasizing long-range, precision fire support, demand for advanced artillery ammunition variants continues to expand. Aerial bombs and specialized munition types represent additional high-value segments that contribute disproportionately to total market value despite smaller unit volumes.

The disaggregated view reveals that market growth is not evenly distributed across all ammunition categories. Faster growth is concentrated in precision, guided, modular, and advanced training variants, while baseline ammunition categories grow more slowly or remain stable.

Frequently Asked Questions (FAQ)

Rising defense budgets worldwide are the primary driver, reflecting increased military modernization, geopolitical tensions, and the need for advanced precision-guided munition systems. Regional conflicts and NATO expansion also sustain elevated demand.

Asia-Pacific countries are rapidly increasing defense spending and modernizing military capabilities in response to regional security challenges and technological competition. China, India, Japan, and South Korea are particularly significant contributors to regional expansion.

Yes, most market reports include both military/defense and civilian hunting and sporting ammunition segments. Civilian demand, while smaller than military demand, contributes to total market value and represents a more stable, less volatile revenue stream.

Precision-guided and intelligent munition systems command higher per-unit prices and represent a rapidly expanding market segment. These advanced systems are driving overall market value growth even when traditional ammunition unit volumes may grow more modestly.

Modern militaries are increasingly adopting environmentally compliant and precision munitions to minimize collateral damage and meet regulatory requirements. This regulatory environment favors advanced, higher-value ammunition over legacy systems, supporting market expansion toward premium product categories.

Kailon Kirby is a digital marketer working alongside a dedicated team at Target Sports USA. Equal parts data nerd and creative thinker, he’s passionate about crafting content that actually hits the mark, whether you're a longtime gun owner, weekend range-goer, or just starting to explore the world of ammunition.

He blends SEO smarts with real industry insight to make sure readers find what they’re looking for, and enjoy the journey along the way. When he’s not working on major projects or geeking out over SEO traffic trends, he’s probably researching the next big thing in shooting sports.