Quick Summary: As we head into 2026, ammunition availability remains shaped by upstream production limits rather than short-term demand. From what I track weekly, supply continues to improve in some calibers while remaining uneven in others. The primary constraints are smokeless powder, primers, and energetics materials that require years to expand production. Pricing remains sensitive to raw material and manufacturing costs, not panic buying. The most reliable approach for shooters is planning purchases around actual usage, understanding that availability will continue to arrive in cycles rather than fully normalize all at once.

Update – January 21, 2026

Since this article was originally published, additional confirmed information has emerged regarding ammunition pricing in 2026. Several major ammunition brands have since announced new price increases scheduled to take effect April 1, 2026, reflecting continued volatility in raw material costs and supply conditions. Readers can find the latest details and brand-specific updates in our most recent coverage here: Federal, CCI, Remington and Other Major Ammo Brands Announce April 2026 Price Increases

We’ve already seen what Kinetic Group’s pricing look like heading into 2026 based on our prior analysis… That’s if you read Kinetic Group Announces Ammo Price Increase – Effective October 1, 2025

Over the past several years, ammunition availability has been shaped by more than just consumer demand. As we head toward 2026, supply conditions continue to reflect structural limits inside the ammunition supply chain, particularly around powder, primers, and upstream raw materials.

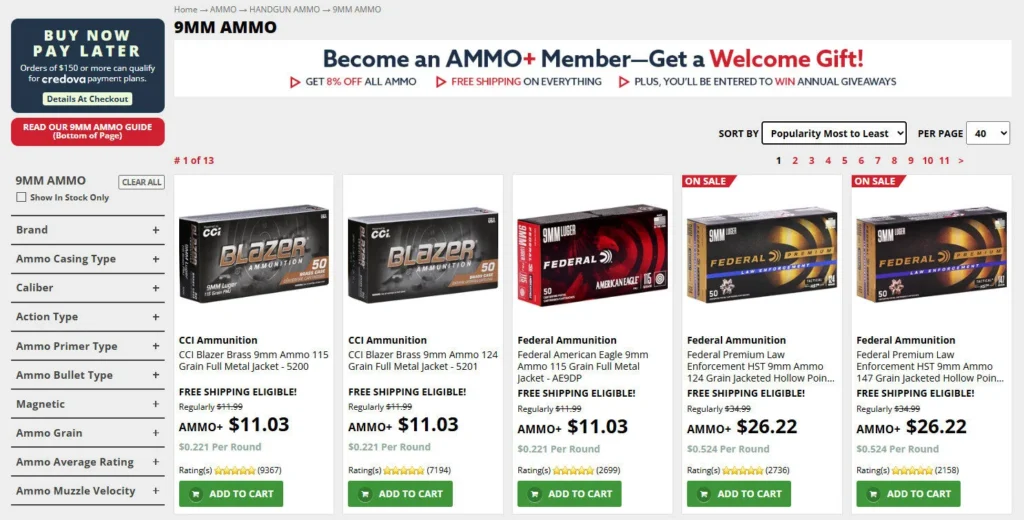

From our side, this isn’t theoretical. Each week, I review availability, pricing movement, and restock velocity across a consistent basket of high-volume calibers. In our most recent checks, run at 9:00 AM ET on Monday and again on Friday, we saw availability improve in some categories while others tightened within days of restocking. That pattern has repeated itself more often than not over the past year.

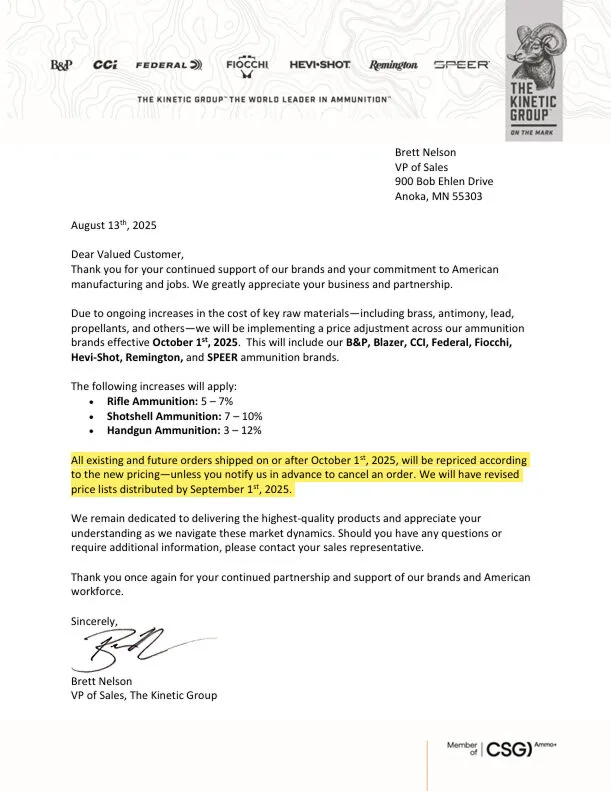

Price pressure has followed the same trend, 3-8% price hikes from brands like Winchester and 3-12% increases from The Kinetic Group brands. In late 2024 and into 2025, manufacturers began issuing cost increases tied to raw materials, labor, and production inputs. We documented one of the more impactful examples in our own analysis of the October 1, 2025, Kinetic Group, Inc. price increase written back on August 26th, 2025, which directly affected multiple popular calibers, product lines, and brands (Federal, Remington, CCI, Speer, Fiocchi, Hevi-Shot, Blazer, and B&P). That increase wasn’t isolated, it reflected broader cost realities that continue to influence pricing today.

What’s important for shooters to understand is this: ammo supply in 2026 is unlikely to feel “unstable,” but it also won’t feel fully normalized. Availability will continue to come in waves. Some calibers will stabilize faster than others. Pricing will remain sensitive to upstream inputs rather than short-term demand spikes.

This outlook isn’t meant to create concern, it’s meant to provide clarity. When buyers understand why availability shifts and prices move, they can plan purchases more effectively and avoid reacting to headlines that don’t reflect what’s actually happening on the ground.

In the sections that follow, I’ll break down what’s really constraining ammunition production, why those constraints take years, not months, to resolve, and what we’re actively watching as we move into 2026.

What Actually Bottlenecks Ammunition Supply

When people talk about ammunition shortages, demand is usually the first explanation offered. In practice, demand is rarely the limiting factor. What I see week to week is that production capacity is constrained upstream, long before a cartridge reaches a loading line.

Brass and projectiles are relatively flexible. They can be produced by a wide range of manufacturers and scaled with fewer regulatory hurdles. Smokeless powder and primers are different. They rely on specialized chemical processes, tightly regulated facilities, and a narrow set of suppliers that cannot expand output quickly. “Go figure, right?”

This is not an assumption. It is explicitly acknowledged at the federal level. In 2024, H.R.8066 – Ammunition Supply Chain Act, Congress required a formal review of the United States smokeless gunpowder supply chain, including nitrocellulose, nitroglycerin, and acid production inputs. Those materials form the chemical backbone of modern propellants. When any part of that chain tightens, ammunition output tightens with it.

At the same time, policymakers have publicly recognized that global supply chain strain has made ammunition harder and more expensive to produce. Senator James Risch summarized this reality by noting that global supply disruptions have increased costs and made ammunition acquisition more difficult across the board.

From an operational standpoint, I see the effects of these constraints in restock behavior. When powder availability tightens, manufacturers do not reduce output evenly. They prioritize specific SKUs, delay others, and shift production schedules. That is why certain calibers can appear stable while others go quiet for weeks at a time.

External reporting supports this pattern. Financial Times has documented how global demand for energetics materials like nitrocellulose has increased significantly since the start of large scale military conflicts, particularly in Europe. These materials are not interchangeable, and they are not easily substituted.

The key point is this. Ammunition supply is not governed by retail demand alone. It is governed by chemical production capacity, regulatory timelines, and upstream prioritization. When shooters see availability arrive in waves, that is not randomness. It is the visible output of a tightly constrained industrial system operating at its limits.

In the next section, I will explain why these constraints do not resolve quickly and why even well funded expansion efforts take years before they change what buyers see on the shelf.

Why 2026 Still Will Not Feel Fully Normal

One of the most common questions I hear on forums like Reddit, Quora, and other sources is why ammunition supply has not fully normalized yet and when it finally will. The honest answer is that industrial recovery does not move at the speed of retail demand. Even when demand cools, production capacity does not instantly rebound.

From what I track week to week, availability does not decline across the board. Instead, it rotates. One caliber improves while another tightens. That rotation is a strong signal that manufacturers are working within fixed upstream limits rather than responding to sudden buying spikes.

Expanding powder or primer capacity is not comparable to adding another assembly line. Energetics facilities require extensive permitting, environmental review, and safety approvals. These processes are measured in years, not quarters. Even after approval, construction and validation add more time before production output changes in a meaningful way.

This reality has been acknowledged in mainstream reporting. Financial Times has reported that Western manufacturers face persistent bottlenecks because critical propellant materials such as nitrocellulose remain in high demand globally. As the article notes, demand for these materials has surged alongside sustained military consumption, which limits how quickly civilian markets feel relief.

Government investment trends reinforce this point. In 2024 and 2025, the U.S. Army announced major funding initiatives to expand artillery and munitions capacity, including new production facilities and modernization projects. These investments are long term by design and signal that energetics output will remain strategically prioritized.

When I overlay this information with what we see in stock movement, the picture becomes clearer. Supply is not collapsing. It is being carefully managed. Manufacturers allocate output where they can, when they can, based on material availability rather than market preference.

That is why 2026 is unlikely to feel like a sudden return to pre shortage conditions. Improvement will be incremental. Availability will improve in some categories while remaining uneven in others. Pricing pressure will ease slowly rather than reset all at once.

This does not mean buyers should expect constant scarcity. It means expectations should be realistic. Ammunition supply in 2026 will function, but it will continue to reflect the limits of an industry that cannot expand its most critical inputs quickly or cheaply.

In the next section, I will explain how isolated industrial incidents can further stress an already constrained system and why redundancy in energetics production remains limited.

How Single Industrial Incidents Can Stress the Entire System

One of the least understood aspects of ammunition supply is how fragile upstream capacity can be, even when overall demand remains steady. Because smokeless powder and energetics production is concentrated in a small number of specialized facilities, a single disruption can create ripple effects far beyond the immediate site.

This is not hypothetical. In October 2025, an explosion occurred at an industrial facility in Hickman County, Tennessee. The incident triggered a response from the Tennessee Emergency Management Agency, the Bureau of Alcohol, Tobacco, Firearms, and Explosives, and the ATF National Response Team. According to the official flash report, federal investigators were deployed to assist with scene examination and investigative support.

What matters here is not speculation about downstream effects. It is the structural reality that incidents like this remove capacity from an already tight system, even if only temporarily. Energetics facilities are not easily replaced, and production cannot simply be shifted elsewhere overnight.

Local and regional reporting reinforced the scale of the response.

News outlets like WPLN covering the incident confirmed extended closures, safety evaluations, and federal involvement. These steps are necessary and appropriate, but they also illustrate why recovery timelines in this sector tend to be measured cautiously.

From a market perspective, I do not see these incidents show up as immediate shortages across all calibers. Instead, the effects are delayed and uneven. A manufacturer may continue producing certain SKUs while others disappear from distribution for weeks or months. To buyers, this can look random. In reality, it is often the result of a single upstream disruption working its way through a long production pipeline.

This is one of the reasons ammunition availability often arrives in waves. The system has very little slack built into it. When something goes offline, even briefly, the impact lingers.

Understanding this helps separate real risk from online rumor. Industrial incidents do not mean the market is collapsing. They do mean that recovery is fragile and that redundancy in critical materials remains limited.

In the next section, I will explain how government procurement and long term defense demand intersect with this same supply chain, and why those signals matter to civilian buyers even when shelves look full.

Government Demand Signals That Affect Civilian Availability

When evaluating ammunition availability, I pay close attention to government procurement signals also. Not because civilian buyers compete directly with the military for finished ammunition, but because both markets rely on the same upstream materials, especially powder, primers, and energetics inputs.

Federal agencies have been clear that domestic munitions capacity is a strategic priority. The U.S. Army Joint Munitions Command outlines its mission as ensuring consistent production readiness to meet current and future operational requirements. This mission includes oversight of large scale production facilities and long term investment in ammunition infrastructure. (U.S. Army Joint Munitions Command PDF Sheet)

In parallel, the Army has funded major modernization and expansion efforts at facilities such as the Lake City Army Ammunition Plant. Public releases describing these efforts emphasize long term capacity building rather than short term output spikes. That distinction matters. These projects are designed to secure supply over decades, not to immediately relieve commercial market pressure.

Mainstream reporting supports this interpretation. Axios has covered U.S. Army plans to significantly increase artillery production capacity through new facilities and upgraded production lines. The reporting highlights multi year timelines and sustained government demand rather than temporary surges.

From my perspective, this explains why civilian ammunition supply can feel stable one month and tight the next. When upstream materials are allocated, government contracts tend to be prioritized. Commercial production adjusts around those allocations rather than replacing them.

This does not mean civilian markets are ignored. It means they operate within a fixed supply framework that responds slowly to change. Even when retail shelves look healthy, the system underneath remains tightly balanced.

I also track how these signals translate into pricing. When manufacturers face higher input costs or tighter material access, those pressures eventually surface as price adjustments. We covered one such adjustment in our own analysis of the Kinetic Group, Inc. price increase, which detailed how rising production costs moved downstream into retail pricing. That increase was not an anomaly. It was a reflection of broader cost pressure across the industry.

The Kinetic Group Price Increase breakdown:

- Rifle Ammunition: 5-7% increase

- Shotshell Ammunition: 7-10% increase

- Handgun Ammunition: 3-12% increase

Understanding these demand signals helps explain why price movement and availability often shift together. It is not speculation. It is the visible result of upstream prioritization and long term procurement strategy.

In the next section, I will walk through how we track availability internally and what those weekly observations reveal about the direction of the market heading into 2026.

What We Track Weekly and What the Data Tells Us

To understand where the ammunition market is heading, I do not rely on headlines or isolated reports. I rely on repeatable weekly tracking. This gives us a grounded view of availability trends rather than snapshots taken during unusually good or bad weeks.

Each Monday and Friday at approximately 9:00 AM ET, I review a consistent basket of high-volume calibers. That basket includes 9mm, 5.56 NATO, .223 Remington, .45 ACP, .308 Winchester, 12 gauge target loads, and .22 LR. These calibers represent the majority of training, competition, and recreational shooting volume.

For each caliber, I log several specific data points:

- Number of in-stock SKUs

- Number of bulk or case quantity options

- Lowest observed price per round where applicable

- Restock frequency since the previous check

- How quickly popular SKUs sell through after restock

This process has been consistent for more than a year, which allows patterns to stand out clearly.

What I see most often is not broad disappearance, but rotation. A caliber that shows strong availability on Monday may tighten by Friday. Another may restock mid-week and remain available longer. That behavior tells me manufacturers are allocating output selectively rather than evenly.

Pricing behavior follows a similar pattern. Prices rarely move abruptly without warning. Instead, they adjust after sustained input cost pressure, often following manufacturer announcements or upstream cost increases. This aligns closely with what we documented in our breakdown of recent manufacturer price adjustments, including the Kinetic Group increase we covered on our blog.

When I overlay this internal tracking with public information about powder production constraints and government demand, the conclusions line up. Availability improves when upstream inputs loosen and tightens when they do not. The retail market reflects industrial reality with a delay.

This is why I am cautious about predictions that suggest a sudden return to pre-shortage conditions. The data does not support that. What it supports is gradual improvement with continued variability, especially in calibers tied to high training or defense demand.

In the next section, I will outline what this means for buyers in practical terms and how shooters can plan purchases intelligently without reacting to short term noise.

How Shooters Can Buy Smarter Heading Into 2026

One of the clearest lessons from the past several years is that panic buying rarely helps the individual shooter. “We all remember what the COVID-19 Pandemic was like.” It drives prices up quickly and drains availability without improving long term access. Planning, on the other hand, consistently leads to better outcomes.

From what I see in weekly stock movement, buyers who purchase based on actual usage rather than fear tend to pay less over time and experience fewer gaps in availability. That starts with understanding how much ammunition you realistically shoot in a month or season.

For training and range use, bulk purchasing during stable periods remains the most effective strategy. When availability improves, even briefly, buying a case rather than multiple small orders often results in better pricing per round and fewer shipping costs. This is especially true for high volume calibers like 9mm, 5.56 NATO, and .22 LR.

Competition shooters benefit from a similar approach, with an added emphasis on consistency. When a specific load performs well, it makes sense to secure enough for an entire season rather than relying on future availability. From our tracking, competition oriented SKUs tend to sell through faster after restocks, even when overall supply appears healthy.

Hunters face a different challenge. Seasonal demand combined with limited production runs means hunting calibers can disappear quickly and reappear unpredictably. Planning purchases well ahead of season has proven far more reliable than waiting until fall inventory ramps up.

Safe storage also plays a role in smart buying. Purchasing in bulk only makes sense if ammunition is stored properly in a cool, dry environment. The Sporting Arms and Ammunition Manufacturers’ Institute provides clear guidance on safe ammunition storage and handling, and I recommend following those standards closely.

The goal is not to overbuy. It is to buy deliberately. When shooters match purchasing habits to real use and understand how supply cycles work, availability becomes far less stressful.

In the next section, I will answer the most common questions we receive about ammunition supply, pricing, and availability heading into 2026.

Ammunition Supply FAQs for 2026

Some supply constraints are likely to continue into 2026, particularly for high volume and specialty calibers. What I see consistently is not total absence, but uneven availability driven by upstream material limits rather than retail demand alone.

Availability comes in waves because manufacturers allocate production based on powder and primer availability. When materials are available, output increases. When they tighten, certain SKUs are delayed while others continue. This creates visible cycles at the retail level.

Demand plays a role, but pricing is increasingly tied to production costs. Powder, primers, labor, transportation, and compliance costs all influence price. We outlined one example of this dynamic in our coverage of the Kinetic Group price increase, which reflected broader cost pressure rather than a temporary surge in buying.

Yes. High volume training calibers tend to recover faster because they are prioritized in production schedules. Niche, seasonal, and specialty calibers often see longer gaps between restocks.

Production capacity is increasing, but slowly. Expansion in powder and primer production takes years due to permitting, safety requirements, and construction timelines. This is why improvement tends to be gradual rather than immediate.

Government procurement affects upstream materials that both markets rely on. When those materials are prioritized for long term contracts, civilian production adjusts around those allocations. This does not eliminate civilian supply, but it does influence timing and volume.

Large price drops are unlikely in the near term. What I see instead is price stabilization with periodic adjustments. Prices respond more to sustained cost changes than to short term availability swings.

No. .22 Long Rifle is a rimfire cartridge and cannot be reloaded. Spent cases should be properly disposed of after use.

The most effective approach is to plan around actual usage. Buying during stable periods, purchasing in bulk when appropriate, and avoiding panic driven decisions consistently leads to better outcomes.

Final Thoughts: Planning Beats Panic

As we move toward 2026, the ammunition market is best understood as constrained but functional. Supply chains are operating, manufacturers are producing, and availability continues, even if it is uneven at times.

From what I track weekly, the biggest advantage buyers can have is understanding how the system actually works. Ammunition supply is shaped by industrial capacity, chemical production, and long term investment timelines. It is not driven by a single headline or isolated event.

At Target Sports USA, our focus remains on transparency, consistency, and long term sourcing. By monitoring availability patterns, documenting pricing changes, and sharing what we see, our goal is to help shooters make informed decisions rather than reactive ones.

This outlook will continue to evolve, and I plan to update it as conditions change. The takeaway remains simple. Smart planning, realistic expectations, and trusted information matter more than ever.

Kailon Kirby is a digital marketer working alongside a dedicated team at Target Sports USA. Equal parts data nerd and creative thinker, he’s passionate about crafting content that actually hits the mark, whether you're a longtime gun owner, weekend range-goer, or just starting to explore the world of ammunition.

He blends SEO smarts with real industry insight to make sure readers find what they’re looking for, and enjoy the journey along the way. When he’s not working on major projects or geeking out over SEO traffic trends, he’s probably researching the next big thing in shooting sports.